by

Philip Brown - Head of Research, FIIG Securities | Apr 12, 2024

The US CPI has blown open the expectations for the FOMC. Australian bond yields are reacting to the US for now, but our own data coming over next two weeks is critical.

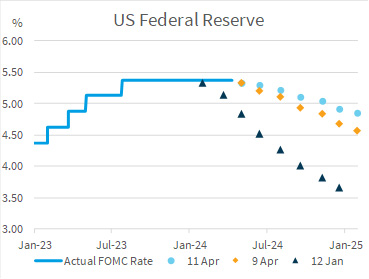

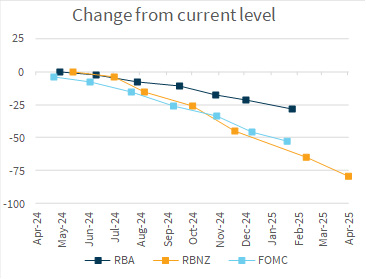

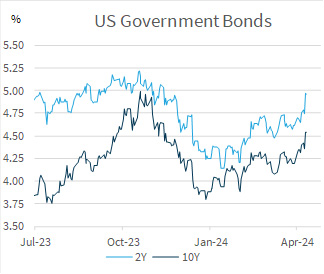

- The US CPI print has completely repriced the US curve. The repricing had already moved a long way (see chart) but the move on CPI simply exacerbated everything. Pricing for the US is now not particularly different from where the RBA pricing was not so long ago – though the RBA pricing is moving too. The market pricing now suggests the FOMC is expected to cut in September, with the first RBA move now not priced until December. FIIG research believes the US pricing is now quite reasonable and reflects the developing situation in US data.

Source: FIIG Securities, Bloomberg.

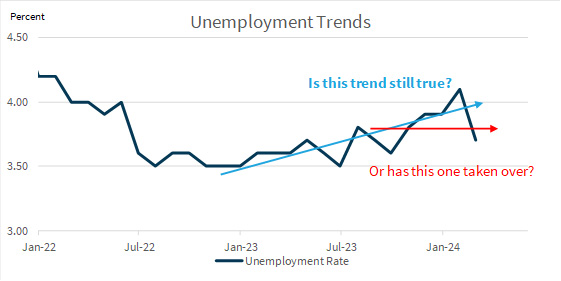

- The Australian situation is harder to read. The next couple of weeks will be pivotal. Australian labour force is released on 18 April. After the surprise large fall in the unemployment rate to 3.7% in February, many are expecting the unemployment rate to rise back substantially. The key, in my view, will be if the upward trend that was visible in most of 2023 reasserts or whether the February print shows the trend is changing. We won’t know that for sure from one more release, but we should get a good sense. Certainly, if the unemployment rate prints at 3.7% again, or even 3.8%, it will be hard to make the argument that the uptrend in unemployment remains in place.

Source: FIIG Securities, Bloomberg, ABS.

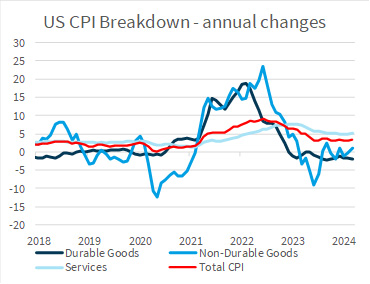

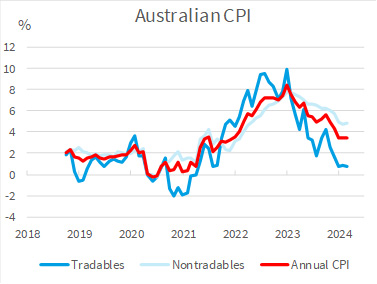

- The week after the labour force brings CPI on 24 April. This will be pivotal because, as we’ve just seen in the US, CPI data can prove very sticky. Unfortunately, it seems that the same dynamics that caused the inflation to remain sticky in the US may be at play in Australia, too. In the US, the fundamental problem is that the fall in the inflation rate was driven by falls in goods prices. US services prices, which are far more consistent, fell a touch but could never establish a strong downtrend. The problem was that goods prices had not just stabilised; for a good part of 2023, goods prices were actively falling. That’s not sustainable in the medium term. Even after a sharp run-up in prices, there is only so far prices can actively fall. And so, as we move into 2024, goods price inflation, particularly non-durable goods inflation, has stabilised at just above zero. But just above zero is not low enough to bring down the average inflation rate back towards the FOMC target of 2%. In Australia, this same dynamic of the fast-moving items obscuring the stickiness of the slow-moving items can be seen in the Tradables vs Nontradables CPI. Tradables CPI (CPI for items where the price is set globally) has been falling sharply and is now sitting at an unsustainably low +0.8% y/y. Like US Goods inflation, Australian tradables inflation will likely not be able to drop any further and may well rise. Australian Nontradables (which are things where the price is set locally and mostly services) are looking far stickier and show an inflation rate of 4.8%. If the tradables inflation can’t control the overall trend anymore the stickiness of the Nontradables could well be unmasked.

Source: FIIG Securities, Bloomberg, ABS, US BLS.

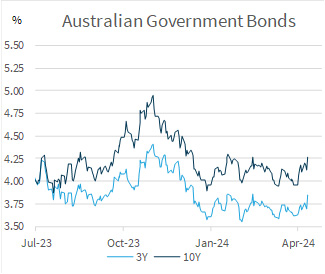

- Bond markets are still distinguishing between the US influences and the Australian. US yields have been trending much higher over all of 2024, meanwhile the Australian yields have been largely range-bound. The Australian bond yields are sitting near year-highs in yields at present, but the range is still clearly visible. Meanwhile, the US yields are trending higher and seeming to set new year highs daily.

Source: FIIG Securities, Bloomberg

- After such a strong move higher in recent weeks, and with the US pricing now for barely one rate cut over the balance of 2024, the market has probably gone far enough in practical terms, but the momentum is still strong. Markets tend to overshoot, and I wouldn't be at all surprised if the US market does so here. But much like the strong sell-off in January saw a temporary retracement, there will be a pullback coming soon – I'm just not clear if it's going to be a day away or a fortnight away. For Australia, we have a large amount of significant data coming in the next two weeks. The May RBA decision will be made by the labour force data and the CPI print. Things could get quite volatile in the short term, but with the Australian curve now only pricing one rate cut over the next year, there's not that much more space for a sell-off unless markets are willing to price another RBA move higher. While the RBA does threaten that, the market has been exceptionally reticent to price rate hikes, and we doubt they will do so here unless the labour data is great or the CPI data is terrible. We would be actively looking to lock in yields at the higher end of ranges over the coming two weeks, particularly in Australia. The aftermath of both the labour force data (where weakness is widely anticipated and may well not occur) or the CPI data (where the downtrend is susceptible to the fact that tradable CPI can't shoulder the burden anymore) look like prime opportunities to add duration on a short-term rise in yields. The 7Y sector looks like the best place for duration.

- Despite the short-term volatility, we still think a long duration is the best place to be. As we wrote this week, the Australian economy is weakening slowly, emphasis on the weakening, and on the slowly. The market has been focusing on the weakness, while ignoring the slowly. We expect attention to shift to the slowness of the recovery in things like CPI, but that will likely miss the underlying truth that the economy has turned and things are weakening. We expect that come late 2024 or mid 2025, the current bond yields will look very attractive. You just need to ride through the short-term volatility.