by

Philip Brown - Head of Research, FIIG Securities | Mar 22, 2024

Australian labour force data showed the unemployment rate dropped 0.4ppt to 3.7%. That’s almost too good to be true – but even if it’s only half true, it’s still a very strong outcome.

- At first glance, the labour force data was exceptionally strong: +116.5k jobs created and the unemployment rate down to 3.7% from 4.1%. That’s an exceptionally large move and way better than expected (consensus had been looking for +40k jobs created and 4.0% unemployment). Hours worked rose 2.84%. Australian bond yields sold-off about 6-8bp on the news, but against the backdrop of a global rally, the change on the day is not that large. Yields were about 4-5bp higher at the end of Thursday than at the end of Wednesday.

- Unfortunately, the labour force data does have some history of creating unexpected results every so often, which means it’s important to temper your reaction to this highly unusual result. You should temper the reaction, but not completely discount the new information, though. With a result this strong, it is quite likely that there is some measure of sampling error (the polite way of saying good luck) in this February print. However, we don’t think that’s the full story. The good news is unlikely to be entirely luck. It’s possible that the next print will show a rise in the unemployment rate and that’s not necessarily a problem. Let’s say that there’s a 0.2% luck factor here, which would be very large, and so next month the unemployment rate rises back to 3.9%. That would still look very strong compared to where we were in January with a 4.1% unemployment rate. As we said: temper, but don’t fully discount.

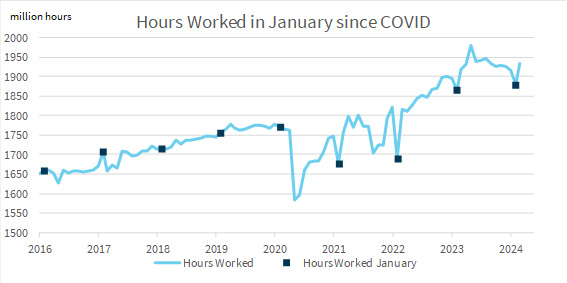

- The timing is also important. These results were the February results and so in some ways are more reliable than the January ones. The January results are notoriously hard to read because it appears the Australian public is changing the way they take holidays and (possibly) how new graduates are hired to begin work in February. The exact mechanism is unclear but what is true beyond doubt is, as the ABS noted today, “The large increase in employment in February followed larger-than-usual numbers of people in December and January who had a job that they were waiting to start or to return to.” There are simply more Australians than usual on holiday in January since COVID. We have also updated the chart we used previously about precisely how atypical the January results are. January has provided a bum steer since the lockdowns. In contrast, in previous years, February has been relatively predictive for how the following months have gone. This year, once again, January and February tell very different stories. If we had to pick one, we’d say February is the more informative, but the truth is probably somewhere in between.

Source: FIIG Securities, ABS

- We haven’t seen any major forecasters alter their forecasts for the RBA based on this data, but we have seen some backpedalling around the risks. The RBA will get to see another labour force print on 18 April before the next RBA meeting on 7 May.

- Equity markets use the phrase “priced for perfection” to mean a situation where a share price is high and can only be justified if everything goes just right. In some ways, the bond market was “priced for putrefication?”. There are ways to get to an RBA rate cut by August, but it would require everything to go consistently wrong. This labour force data is, emphatically, not going wrong and quite the reverse, even allowing for some rise in the unemployment rate as statistical payback in coming months. If the 3.7% unemployment rate holds next print, and there’s any sign of stickiness in inflation, then the RBA might actively consider further rate rises – they haven’t ruled them out. If, as we think is much more likely, there is a small amount of increase in the unemployment rate in the next couple of prints, it still shows the labour market is stronger than the RBA expected it to be which rules out near-term rate cuts, in our view.

- We’ve been highlighting for a while that there was a risk the market had over-egged the pudding on how soon the RBA might cut interest rates. This labour force data reinforces that view. We continue to think the next rate cut is coming in late 2024, somewhere around November.

- The cash rate in Australia is currently much higher than recent years, but not particularly restrictive just yet – at least not in the RBA’s view. The labour data here also opens up a can of works regarding the interaction between CPI and the first rate cut. Many market participants seem to think that as soon as the CPI is reliably in the band the RBA will cut rates. While the unemployment rate was rising that was probably true. But if the CPI drops into the band while the unemployment rate remains below 4.0%, the RBA will be hesitant to cut rates. At the meeting this week, the RBA described an unemployment rate of 4.1% as being part of a labour market that was “tighter than consistent with sustained full employment and inflation at target”. An unemployment rate of 3.7%, if it’s true, would be much tighter than that.