by

Philip Brown - Head of Research, FIIG Securities | Feb 16, 2024

The January labour force data was, superficially, terrible. Following a poor result last month (-65.1K printed, revised to -62.7K) there was some hope that there would be an improvement in the January data released on Thursday. There was not. The economy added an anaemic 0.5K jobs and the unemployment rate rose from 3.9% to 4.1%. The hours worked dropped 2.5%.

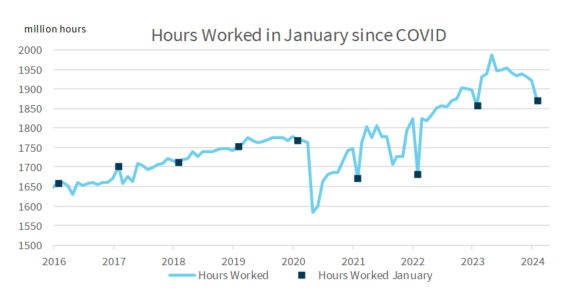

The only saving grace was that this was January data. For statisticians, January is a terrible month. People don’t answer their surveys and the people who do answer their surveys are often doing very atypical things. The ABS attempts to seasonally adjust the data to make up for that, but sometimes seasonal patterns change. The ABS has identified that the way Australians work (or holiday) in January is changing:

“While there were more unemployed people in January, there were also more unemployed people who were expecting to start a job in the next four weeks. This may be an indication of a changing seasonal dynamic within the labour market, around when people start working after the summer holiday period. In January 2022, 2023 and 2024, around 5 per cent of people who were not employed were attached to a job, compared with around 4 per cent in the January surveys prior to the COVID-19 pandemic.”

Specifically, it means that the January ABS data will look weaker than the underlying reality. So does that mean the superficially terrible results in January should be ignored? No, it does not.

There is a clear bias towards weakness in January as “noise” in the data. But it doesn’t mean that the entirety of the January result was noise. Instead, what we take as the signal from this data is that the underlying trend of weakness continued, with the January seasonal oddity sitting on top exacerbating the weakness. Not all the weakness is a true signal, but not none of it either. The reason the January result looks so bad is not because the trend is terrible, or because the seasonal error in January is massive, but rather that the trend is poor and the seasonal error exacerbates it. The weakness in January is both signal and noise.

That data shows that before COVID, the hours worked in January was able to be relatively accurately estimated. Since COVID, January has been very different from surrounding months. But in 2021, 2022 and 2023, the January oddity was set against an underlying strong trend. This month, the trend was weak before the January data. There’s no evidence at all the trend weakened. So although there will probably be some bounce back next month, the downtrend will likely remain in place.

Source: FIIG securities and ABS

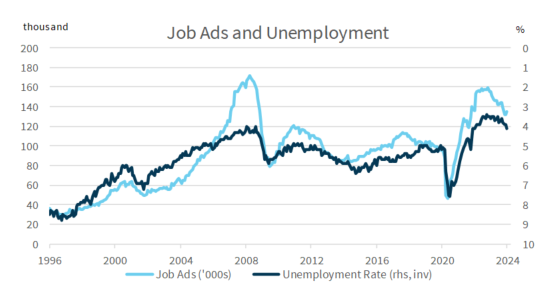

The RBA has been talking about labour market weakness frequently of late. They devoted much of the Statement on Monetary Policy to it. The RBA wants to see a slow weakening of the labour market and that is reasonably evident in the data, even if the January data is attributed partially to noise. The overall position in the labour market is still quite strong, in an absolute sense, but the momentum is poor and showing little signs of improving (see chart). If the RBA does cut rates in in 2024, the labour market will need to have materially weakened.

Source: FIIG securities and ABS

The RBA has moved to six-weekly meetings rather than monthly, but the next RBA announcement, on 19 March, is marginally ahead of the next Labour Force data on 21 March. The wage price data on 21 February will also be material when the RBA next meets. There’s no chance of the RBA cutting rates at the March meeting.

But if the trend towards notable loosening of the labour market data continues, it won’t take too much longer before the RBA starts to publicly change position to a more neutral, or even Dovish stance (much like the one the Fed is currently in). We think the RBA views the current cash rate position at 4.35% as only marginally above neutral. I’m not sure I agree with that assessment, but the RBA holds it. That does mean the RBA wouldn’t be looking to lower rates aggressively at first. But the market reaction could well be sharp. As we were saying in the LOCK strategy, we’re not quite sure when the sharp rally will come, so you need to be prepared for it well in advance.

For more information on Corporate Bonds

Talk to us

Call us on 1800 01 01 81

...with offices based in Sydney, Brisbane, Melbourne and Perth