by

FIIG Research Team | Feb 05, 2024

Residential mortgage-backed securities (RMBS) can seem a bit daunting to investors. Simplistically, an RMBS is the total of many residential loans pooled into a single structure to generate a cash flow to support the repayment of a number of investment tranches. They are a somewhat complicated structure and that can be off-putting. It also doesn’t help that many people immediately associate RMBS with the GFC in 2008-09. However, it’s important to separate the process of building an RMBS from the quality of a particular transaction. Like many things in life, the quality of the ingredients matters greatly to the quality of the total product.

In the early 2000s, many US deals were overly structured and complicated in an attempt to obscure the fact the quality of the initial mortgage assets was weak. That ended in tears as is well known. Australian RMBS transactions are very different. Different rules for how mortgages work in Australia, how banks can lend money, and how loans must be verified create a different quality of initial loan. Higher quality initial loans create a better quality of final investment in Australian RMBS.

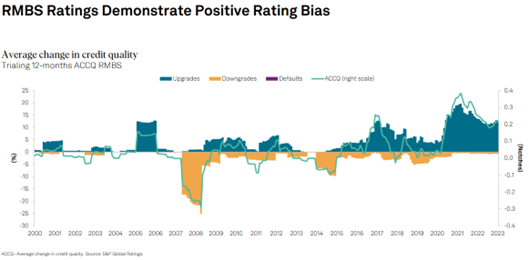

The chart below shows the change in credit ratings across all Australian RMBS issues covered by S&P. Over the last two decades, there have been many more credit upgrades than downgrades, particularly over the last four years. Amazingly, there have been no defaults in the data series – and that includes the GFC!

Source: S&P Capital

The bias towards positive revisions is also a feature of the product itself. An RMBS is built out of mortgages and mortgages are usually improving over time from a credit perspective. As time passes, as long as the mortgage is being paid, the principal balance is falling. Meanwhile, the value of the house is rising over time, on average.

It’s not just the individual mortgages that improve over time, though. As borrowers in the RMBS pool make their payments, the RMBS structure is designed to collect slightly more than necessary, referred to as excess spread. Assuming nothing goes wrong, this residual excess spread builds up in the transaction, further improving the position of the overall structure.

So if things aren’t actively going wrong (see the GFC in 2007-2009 in the chart), then the most likely outcome is that they are slowly going right and the RMBS investments are getting better (see the rest of the chart).