by

Mark Miller - Director – Debt Capital Markets | Dec 19, 2023

An apt description of long-term bond yields in the second half of 2023 could be “what goes up, must come down”…….. But could it go back up again?

For an investment with a reputation for stubborn consistency, bond yields have treated the back end of 2023 more like an amusement park ride.

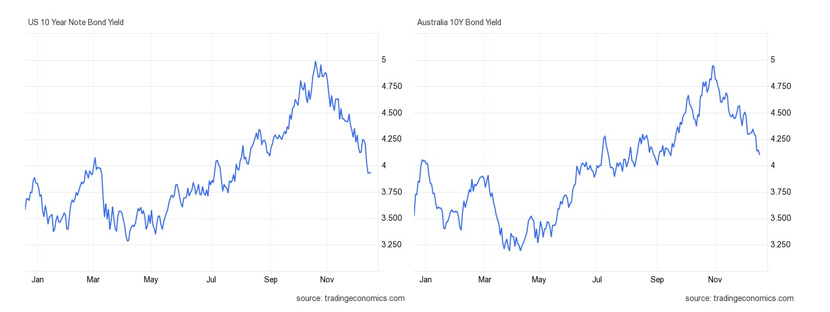

Long-term bond yields unexpectedly screamed higher through September and October, taking the US 10-yr Treasury briefly above the 5.0% yield level for the first time since 2007. Here in Australia, the 10-yr Government reached a peak of 4.96% - its highest point since July 2011.

Then, just as the ‘doomsday’ commentary reached its crescendo, these same bond yields retreated back equally as fast through November. The US 10-yr Treasury has retreated to its current 3.9% and the Australian 10-yr Government to 4.1%.

Many borrowers are now asking whether the peak in yields is behind us. To answer this question, we must consider what is driving long-term yield volatility, and whether these factors apply equally to the corporate markets (and borrowers).

What’s driving recent volatility in long-term yields?

In Australia, the increase in long-term yields over the past two years has coincided with a number of cash rate increases by the RBA, the most recent being a 0.25% hike to its current level of 4.35% delivered at its November 2023 meeting.

However, rate rises are only half the equation, as any change to the cash-rate tends to affect short-dated yields more so than longer term bonds that are instead taking a longer term view trying to capture the next part of the interest-rate cycle. Here, the question being asked is whether current high inflation levels will remain longer into the future.

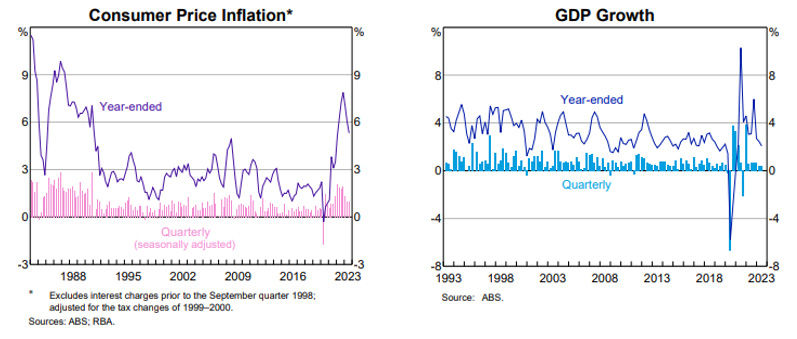

In late October, inflation data released by the RBA showed headline CPI at 1.2% Quarter-on-quarter (vs 1.0% expected) and 5.4% Year-on-Year (vs 5.3% expected). Despite numerous earlier rate rises by the RBA in an effort to rein in prices, this much stronger inflationary data not only led the RBA to pull the trigger on its latest rate rise, but confirmed the then-market view that inflation was not yet under control and ‘higher for longer’ interest-rates would be required. Of note, both the US and Australian Government 10-year yields reached their recent peaks in this same period.

So what has caused this view to change and bonds to rally? Through November, the theme shifted in Australia as further economic data was released and an increasingly pessimistic picture of the economy began to be painted. From its December meeting, the RBA is now forecasting a fairly dramatic slowing in GDP growth (2.1% through the year to June, dropping to 1.6% through the year to December). They are also expecting wages growth “not to increase much further” on the proviso that “productivity growth picks up”.

These data points, alongside the first signs of a slow but steady downward trend in inflationary data, have the market believing that the RBA will need to commence the cash-rate-cutting cycle sooner than previously thought. It is this shift away from the ‘higher for longer’ interest-rate theme and toward a view that rates will be cut within the next 6-12 months that has seen Australian long-term Government bonds rally.

With all of this in the rear-view mirror, the market is now looking forward to determining whether this rally can be maintained or whether long-term yields will revert back to recent highs. Given the market is now factoring in multiple interest-rate cuts through FY24, the expectation is that inflation will continue to fall while economic conditions soften. Should data suggest any deviation from this in the form of improvements to economic conditions and/or slowing in the downward trend of inflation, we could see long-term yields change direction and head higher.

All eyes will be on the next RBA meeting in February – a much longer gap than historically usual – where there will be a lot more information on hand when it sits down to consider the economy and rates. For long-term yields, the focus will not be so much on the cash-rate determination itself, but on the RBA’s interpretation of the data and language adopted with regard to future interest-rate direction.

What does this mean for corporate bond markets?

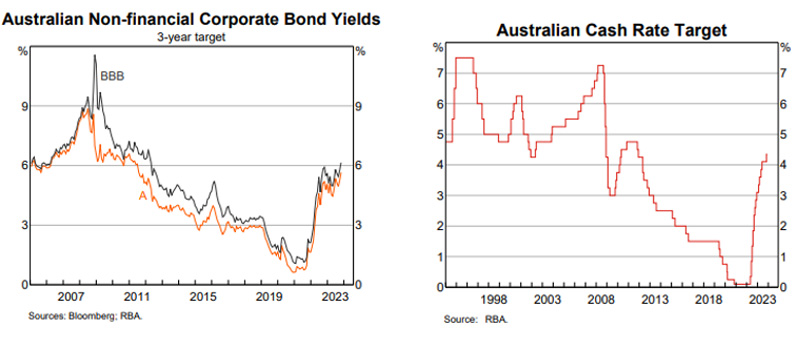

Although corporate bond yields through 2023 have moved in a similar fashion to 10-year Government bonds, the shorter-term nature of corporate issues means they are less influenced by longer-term interest-rate and inflation outlooks and more so by shorter-term rates outlook and spreads.

Analysis shows that changes to Corporate BBB yields through 2023 have largely been influenced by adjustments to the cash-rate, with spreads generally in line with the long-term average. This can be seen in the charts below with 3-year corporate bond yields mirroring changes to the cash rate since 2020.

Of particular note is that corporate bond yields have not fallen in the past month as we have seen with 10-year Government bonds. That’s partly because the 3-year bonds are more tightly linked to the RBA (cash rate) and partly because the 10-year bonds are more closely linked to the international markets, where yields have been falling.

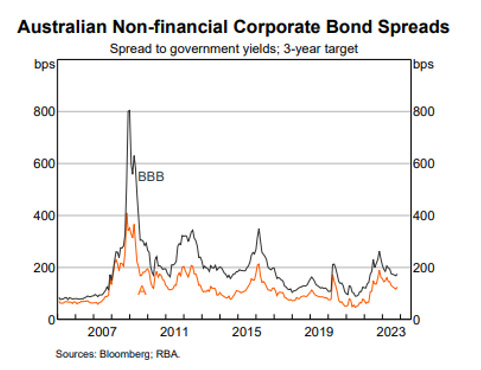

From the below chart, we can see spreads have reduced steadily this year from a recent high in late 2022, suggesting that rising yields do not represent an expectation by investors that bond issuers won’t repay debts, or are at greater risk of not repaying, which would otherwise see spreads rise well above the average.

Negative external factors (most notably the probability of an Australian recession and/or escalated geopolitical uncertainty - particularly in the Middle East) could see spreads head higher in the future, although it is worth noting that spreads have remained fairly resilient to these external factors thus far.

Assuming there is no material increase in spreads, corporate bond pricing will continue to be influenced directly by changes to the cash rate (much more so than long-term Government bonds). If we look for clues to the direction of future interest rates from the RBA’s most recent meeting earlier this month, the key line delivered remains:

“[w]hether further tightening of monetary policy is required …. will depend upon the data and the evolving assessment of risks.”

This is an open admission that the RBA doesn’t really know whether further rate rises are needed or not, and that it will all depend on the evolution of the data. Whilst the RBA is very clearly hoping they don’t have to raise rates again, they also stand ready and willing to do so should conditions warrant.

It is, therefore, a genuine 50-50 chance whether the peak in shorter-term corporate bond yields is behind us, although the market has taken the firm view (at least for now) that rates have well and truly peaked.

Is now a good time for borrowers to issue?

Contrary to all the talk of yield volatility negatively impacting domestic corporate bond activity, the market has remained very active with a sustained level of both repeat and new issuers in 2023.

In the event ‘peak yield’ has been reached, this will be welcome news to borrowers, in particular to those corporates considering floating-rate issues that can take advantage of expected interest rate cuts in the form of lower coupon payments.

Even if interest rates reduce, funding capacity could remain constrained as lenders continue to consider Australia’s current economic uncertainty in the form of sliding annual growth (that is being heavily supported by record migration figures), household spending on the decline, increasing rent, continued drops in building approvals and low consumer confidence. All of this is contributing to a limited funding appetite from both banks and non-bank credit funds.

Contrary to other funding sources, there remains ample liquidity in bond markets. And with corporate activity at a low point, corporates looking to capitalise on a ‘first-mover advantage’ by seizing on counter-cyclical opportunities may be rewarded by locking in long-term committed funding with floating-rates that will benefit from the coming interest-rate cutting cycle.

In addition to offering floating-rate issues, over-the-counter bonds continue to provide an attractive funding source to borrowers for the following reasons:

- OTC bonds are highly flexible in structure (senior, mezz, Holdco, SPV warehouse) and can be customised to suit the borrower (including acquisition flexibility);

- Can accommodate long tenor if required to increase funding certainty, as well as provide a point of diversification in borrowing sources, thereby reducing refinancing risk; and

- Offer the option of fixed and/or floating interest rates to suit the business and/or provide a hedge to interest-rate movements.

For more information on Corporate Bonds

Talk to us

Call us on 1800 01 01 81

...with offices based in Sydney, Brisbane, Melbourne and Perth