The issues of the fiscal cliff were largely ignored in recent months as global markets became focussed more on the US presidential election campaign. The reality is, the inherent risks in the global economy have not dissipated and with the decks effectively cleared (but not particularly clarified) by last weeks’ election, attention turns to what should have been front and centre all along. With market focus moving beyond the election, US indicies dropped 2% on the first full day of trading with oil (a proxy of global growth) dropping 5%.

The pomp and ceremony of a US Presidential election is great entertainment, but to quote former President Bill Clinton; “It’s the economy stupid”.

The background to the fiscal cliff

The fiscal cliff has its roots in an ongoing argument between the Republican controlled House of Representatives and the Democrat controlled Senate and Presidency about the US debt ceiling – Congressional approval for total debt lending by the US government.

The argument over lifting the debt ceiling simmered throughout 2011 as the Republican’s, who’s Congressional approval was required in order to lift the debt ceiling, refused to budge on further increasing the US’s debt levels – the result of which would have required an immediate 40% cut to government spending in order to maintain levels of debt at the ceiling level. Failing to raise the debt ceiling would have also likely resulted in the US defaulting on its debt (though there remains some debate as to whether this would have occurred).

Historically, the raising of the Federal debt ceiling has been a largely administrative task and has barely ranked a mention. However, the Republican Congress, and in particular the ‘Tea Party’ Republicans saw the raising of the debt ceiling (or more to the point, refusing to raise the ceiling) as a back-door way to halt increased government spending.

This game of political brinkmanship continued through the summer of 2011 until finally, under significant pressure from markets and economists, an agreement was reached. The ceiling would be lifted, and in return, on 2 August 2011 the Budget Control Act of 2011 (the Act) was introduced. This is the act which created the fiscal cliff. Four days later, concerned with the government’s inability to deal with the debt ceiling issue in a timely manner ratings agency S&P downgraded the US from ‘AAA’ for the first time in its history. The Dow Jones dropped 312 points (2.36%).

What is the fiscal cliff?

The fiscal cliff is a combination of spending cuts and tax increases which come into effect at the beginning of 2013 included in the Budget Control Act. The term ‘fiscal cliff’ was coined by US Federal Reserve Chairman Ben Bernanke to describe the likely effects of the Budget Control Act.

As the debate raged in 2011 on the raising of the debt ceiling, with the Republicans steadfast in their view that budget cuts were needed to deal with the budget deficit and the Democrats equally resolute that heavy lifting should come from the removal of tax cuts from the richest Americans, a compromise of sorts was agreed – the Budget Control Act. The Act was seen to effectively put a gun to the heads of both sides of politics:

- Tax breaks, including 2% payroll tax deductions, equipment write-offs and individual tax cuts would be removed

- Spending cuts of around US$108bn to departmental spending from defence to Medicare at the Federal government level.

Removal of the tax cuts would run counter to the Republican stance, while spending cuts would affect Democrat social and health programmes. Neither would be good for producing growth in the economy.

The theory was that the Act would encourage both parties to come to the table and compromise in order to achieve some (but not all) of their budgetary goals. A year and a bit later, they are facing the same dilemmas, but now the Act, which was seen to encourage compromise, has become the issue itself.

What are the effects of the fiscal cliff?

So what are the effects of the fiscal cliff? The exact dollar outcome of driving over the fiscal cliff is difficult to define....but it’s not good. The introduction of the Act would see US GDP drop between 4% and 6% (depending of the forecaster), with unemployment increasing 2% seeing another 2.8 million people out of work. Given that the US the biggest trading partner for most major economies in the World, including China, the effect would be devastating. Standard & Poor’s, in its research ‘In the wake of the election, a divided Washington braces for the fiscal cliff’ noted:

“Going over the fiscal cliff would almost undoubtedly sink the U.S. back into recession—and reverberate around the world. Export-led countries would suffer from lost revenue almost at once, while countries that rely on commodity exports would likely feel a hit a few quarters down the road as demand for these commodities, which drive industrial production, dries up.”

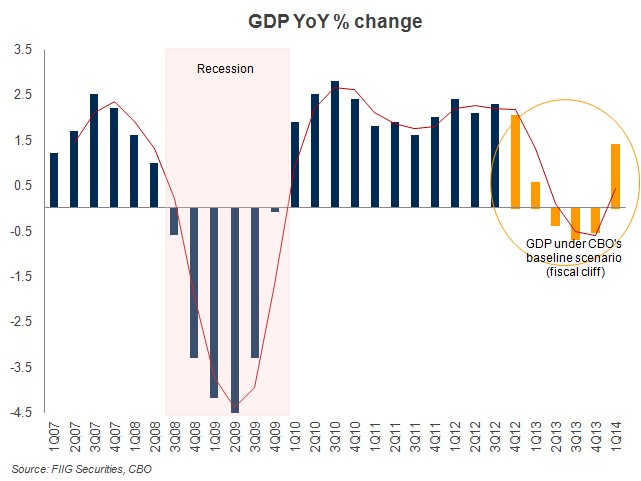

Figure 1 below shows the change in GDP (on a quarter by quarter basis) as calculated by the Congressional Budget Office (CBO) with the effects of introduction of the Act clearly decreasing what is already anaemic GDP growth in the US and causing a contraction in the Federal budget of by much as 5%.

Figure 1

The CBO confirms S&P’s view; the enactment of the Budget Control Act would likely see the US enter a double dip recession. Regardless, the debt ceiling will need to be increased early in 2013 whether the Act comes in to play or not.

Damned if they do, damned if they don’t

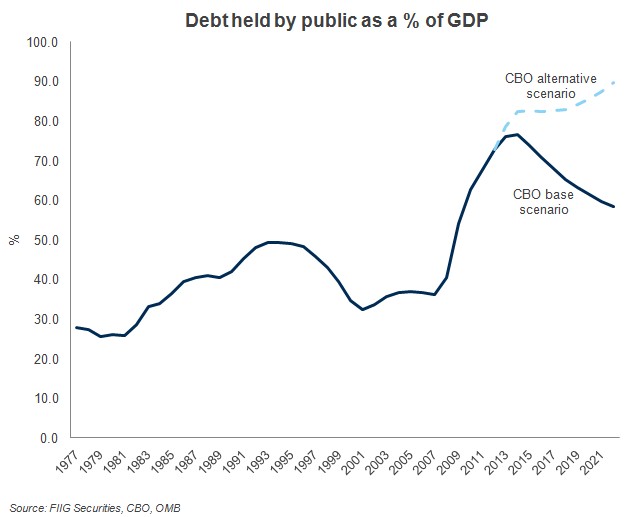

To an extent, the US economy is damned if they do, and damned if they don’t when it comes to the Act. If the Act is enacted, the economy drives off the fiscal cliff described above and enters a double dip recession (though overall government debt would decrease, as shown by the dark blue line in Figure 2 below).

If the act is repealed, and the fiscal cliff avoided, the US government will continue to increase its debt levels (as shown by the pale blue dotted line in Figure 2 below) with still no medium term plan to turn around the $1.1trn deficit.

Figure 2

The S&P AA+ rating of US Treasuries remains on negative outlook reflecting rising indebtedness and ‘the absence of policymakers’ agreement on a credible, medium-term strategy of fiscal consolidation’.

The harsh reality

The CBO base scenario, which sends the US off the cliff and into almost certain recession manages to bring down debt as a % of GDP. The alternative scenario is that US debt continues to grow both on an absolute level and as a % of GDP. At some point, this debt has to be addressed. This is the slow turning titanic that Europe has been grappling with.

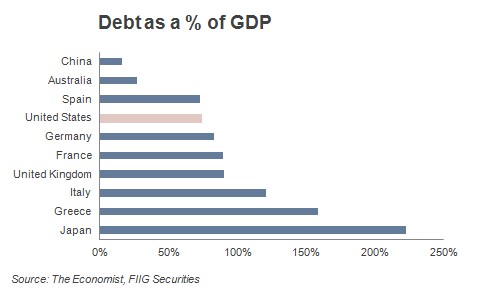

Figure 3

The Economist estimates US debt as a % of GDP at 73%, making the US appear ‘European’ when it comes to debt.

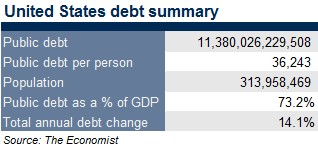

Last year The Economist estimated that public debt in the US grew 14.1%, topping $11trn dollars. That’s $36,243 of public debt for every man, woman and child in the United States. On top of their still depressed housing prices, that’s quite a burden for the US consumer to carry.

Table 1

US debt continues to grow. Last year it grew at 14.1%, so any spending cuts or tax increases have to first stop the growth in debt before the government can consider actually beginning to pay the debt down. At some point, the chickens have to come home to roost.

Surely sanity will prevail?

The reality is that lifting the taxes on the richest Americans would have at best little to no effect on the economy; however this remains a major bone of contention between the Republican Congress and the Democratic President. The Republicans ‘went to the mat’ for these tax cuts in 2011 when the debt ceiling issue first arose – they may be prepared to go there again.

Surely, with a newly elected President claiming a mandate from the people, sanity will prevail and the Republican’s will give ground on tax cuts for those earning more than $250,000? Despite immediate post election talk of reaching a common ground, House Speaker, John Boehner in his first public salvo noted:

“The problem with raising the tax rates on the wealthiest Americans is that more than half of them are small-business owners. Raising taxes will slow down our ability to create the jobs that everyone says they want.”

“For two years, our majority in the House has been the primary line of defence for the American people against a government that spends too much, taxes too much, and borrows too much when left unchecked.”

“With this vote, the American people have also made clear that there is no mandate for raising tax rates.”

Ultimately, the discussions will have little to do with economics. Politics put the country in this impasse in the first place and it is politics which remains the hurdle now.

What now?

The raising of the debt ceiling has historically been an almost administrative procedure, however even this became politicised in the hostile environment of Washington in 2011. Not much has changed. Whilst the President may claim to have a mandate from the people, the Congress also claims a mandate.

The Republican party is yet to digest and dissect their Presidential defeat, not a great environment for the party to move forward as individual members of Congress may be hesitant to give up territory on their beliefs, at least until they are proven to be an electoral negative.

House Speaker Boehner is prepared to compromise, but his idea of compromise is to extend the ‘Bush’ tax cuts into the future in return for trade-offs in deductions and loopholes. The chances of this, a reworking of the US tax code, occurring inside two months appear minimal.

President Obama is prepared to compromise, but can see no reason that the richest Americans shouldn’t be prepared to pay a higher rate of tax.

What is the likely outcome – it is impossible to say, but one scenario includes a further extension of the status quo. Kicking the can down the road has not worked in Europe, and it will not work in the US. One thing is for sure, investment markets do not take kindly to uncertainty, and sabre rattling from either side of politics is unlikely to result in positive outcomes for the share market.

Any agreement will likely to be at best, one of a number of bad alternatives. Take the pain now, or take the pain in the future, neither is great for the prospects of near term global growth. The markets will be watching the outcome, there’s 48 days and counting.