What is a bond?

A bond is a security that pays a defined distribution (the coupon) for a given period of time (the term) and repays the face value of the security at maturity.

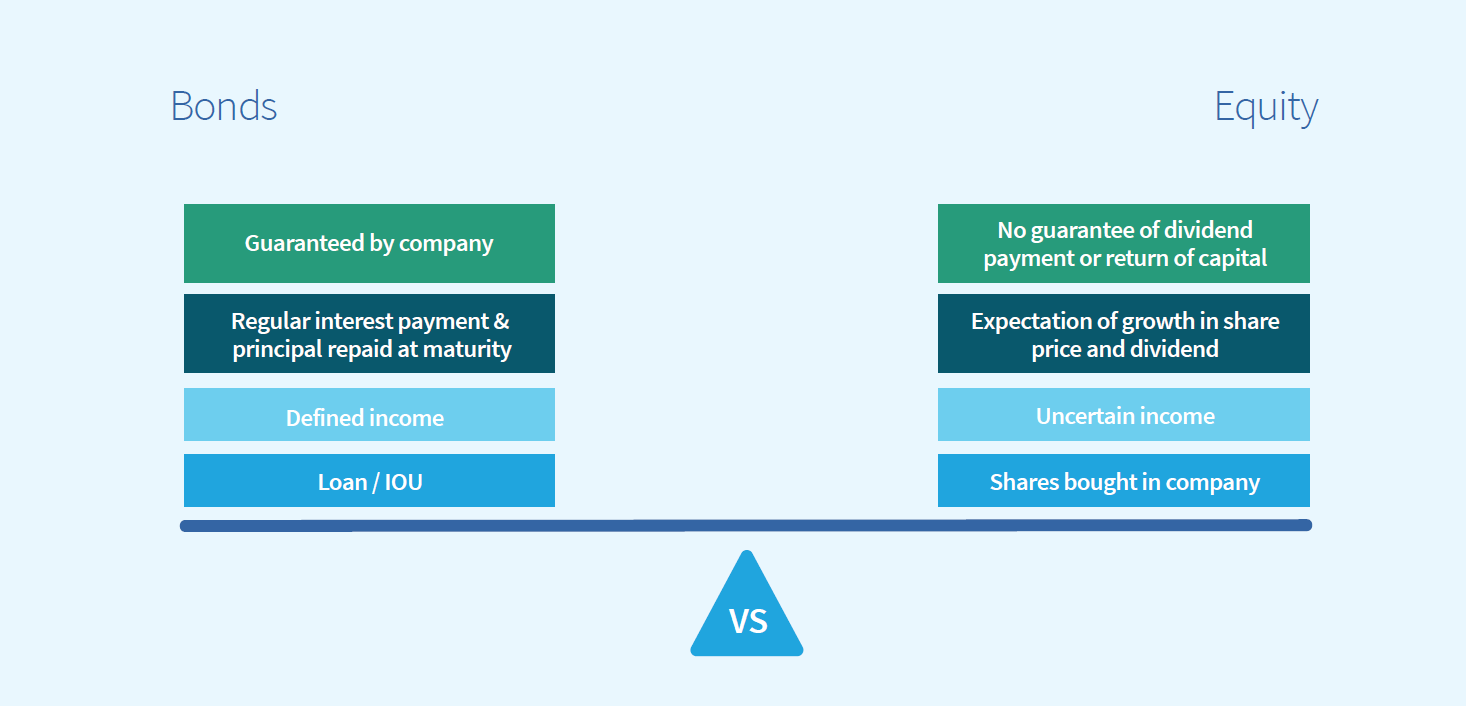

Unlike an equity, which is purchased ownership of a company, a bond is a loan from an investor to the issuer of the security. There are many types of bonds, including fixed, floating, amortising, annuities, index-linked and Eurobonds.

Bonds v Equity

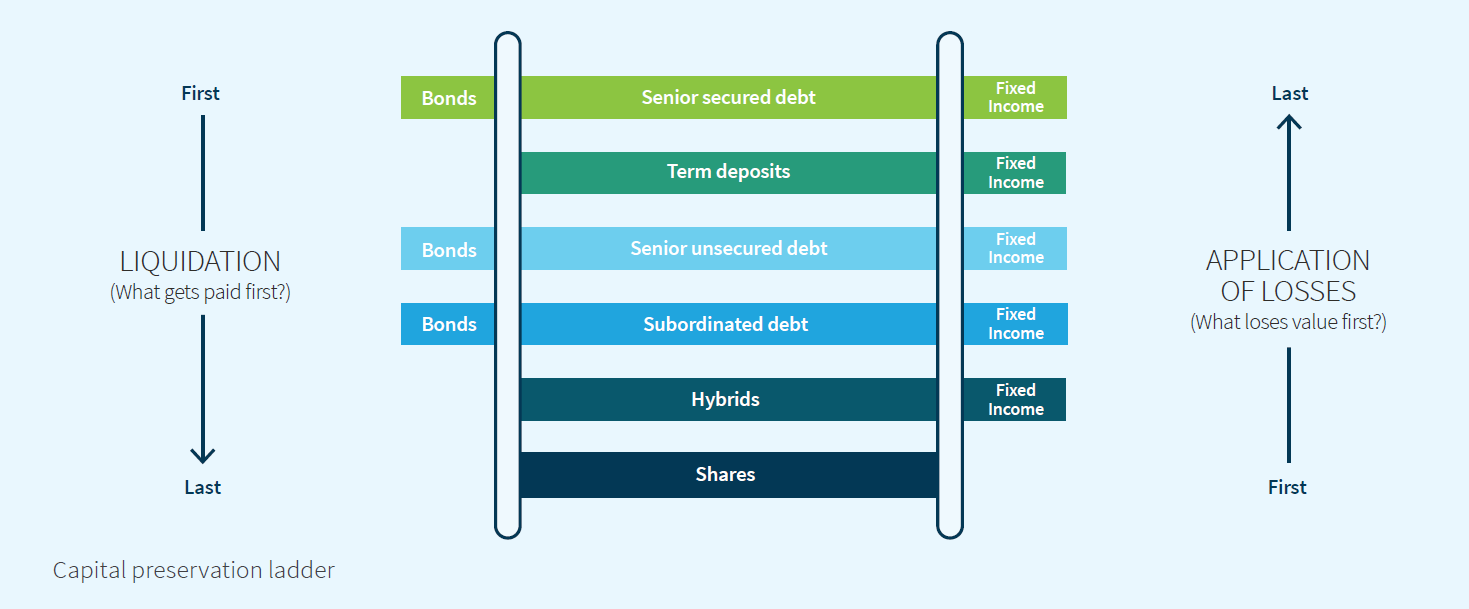

Bonds can be issued as senior secured, senior unsecured and subordinated debt. Each of these three debt classes has varying risk and reward attributes which are also influenced by the issuing entity’s credit rating.

Advantages

- Wide variety of maturities

- Wide variety of issuers rated across the credit rating spectrum

- Provides steady income

- Potential for capital gains if sold prior to maturity

- Can be used to diversify investments in a balanced portfolio

- Cover three levels of capital structure

- Government bonds offer greater diversification

Disadvantages

- Varying liquidity

- Most bonds are traded over the counter, rather than through an exchange

- Potential for capital loss if sold prior to maturity

- Bond markets are currently dominated by Wholesale investors in Australia

- Corporate bonds offer less diversification than government bonds

Suitable for

- A very wide range of investors with differing risk and reward attributes, from conservative investors through to those seeking high risk securities

- Retail and Wholesale investors

Capital Structure

When purchasing a bond, it is important to understand where the bond sits in within the company’s capital structure table below, to determine the potential risk and reward of the investment.

Capital Structure - Bank

Fixed v. Floating rate bonds

Two of the most common types of bonds are fixed rate bonds and floating rate notes.

Fixed rate bonds pay a pre-determined distribution which is set at the time of issue and does not change throughout the life of the bond. Floating rate notes pay a distribution which is linked to a variable benchmark (in Australia this is usually the bank bill swap rate - BBSW).

Investors may choose to invest in fixed or floating bonds to better meet cash flow requirements or because of a better perceived return on one bond over another.

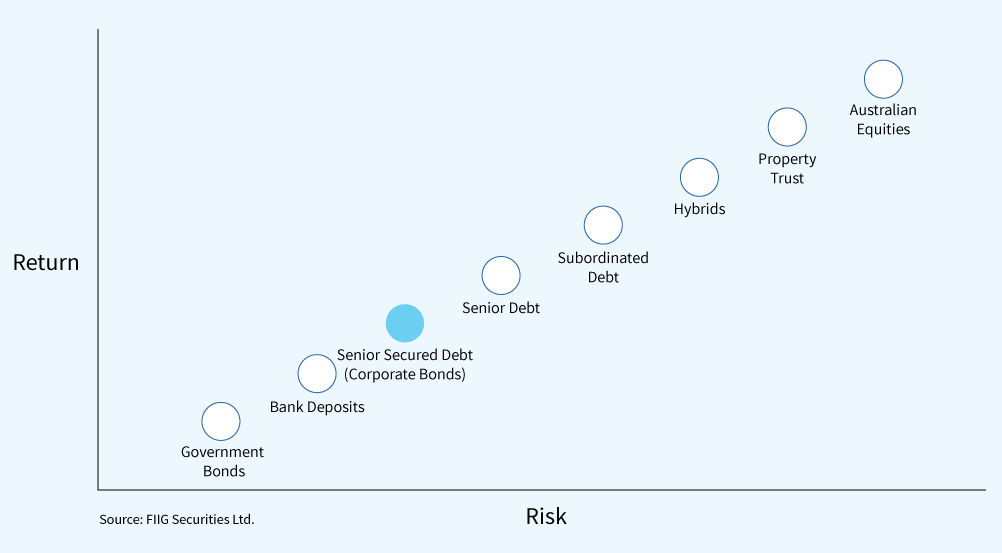

Risk v Return

Investing in bonds

The bond market comprises of a primary and secondary market. The primary market contains new issue bonds which are sold to the public and enter the bond market for the first time.

A bond may be listed and therefore may be bought and sold directly by investors on the Australian Stock Exchange (ASX). The majority of bonds are traded over the counter (OTC) through a fixed income broker, such as FIIG, who negotiate the sale of bonds between buyers and sellers. This secondary bond market, allows the sale of purchased bonds prior to maturity.

One of the main benefits of investing in bonds is that coupon payments are a legal requirement by the issuer; that is the bond holder must be paid or the entity will be in default. This requirement provides a more stable income from investment than other investment types such as a dividend received from an equity share. This feature is important for investors seeking a regular income from their investment.

What are the benefits of investing in bonds?

Bonds provide a wide range of benefits to investors, including:

Capital stability

Bond holders have priority over hybrid and equity holders in the event of company liquidation. Assuming the issuer of a bond remains solvent, the company is contractually obliged to pay back the principal value to the bondholder.

Regular income

Fixed income securities provide a regular income stream through coupon (interest) payments, giving holders the ability to tailor their portfolio maturities.

Liquidity

Bonds provide investors with varied levels of liquidity. Low risk, highly liquid fixed income investments like government bonds can be sold at short notice if needed, however some other corporate bonds may not be as liquid as government bonds. It is important to remember that bonds can be sold prior to the maturity date.

Liability management

Typically, bond maturities vary from one to ten years and can be traded before maturity to meet liabilities.

Diversification

Holders of fixed income securities enjoy diversification from the two most highly cyclical asset classes - equities and property.

Higher returns than deposits

Many investors use term deposits which deliver minimal risk but generally earn relatively low returns. By moving slightly down the bank issuer's capital structure (see diagram above) into bonds (senior or subordinated) investors can retain their exposure to the issuer but earn a higher return.

Downturn protection

Generally, a fixed income allocation will act to protect your portfolio during a cyclical downturn. A larger allocation will provide greater protection.